6.1. Cash flow assessment

Estimation of projected cash flow- the most important stage in the analysis of an investment project. Cash flow, in its most general form, consists of two elements: required investments - outflow of funds - and cash inflows minus current expenses - cash inflows.

Specialists from different departments are involved in the development of a forecast estimate, usually the marketing department, design and engineering department, accounting, financial, production departments, and procurement departments. The main tasks of economists responsible for investment planning in the forecasting process:

1) coordination of efforts of other departments and specialists;

2) ensuring the consistency of the initial economic parameters used by the participants in the forecasting process;

3) counteraction of possible bias in the formation of assessments.

Relevant - Representative - Cash Flow the project is defined as the difference between the total cash flows of the enterprise as a whole for a certain period of time in the case of the implementation of the project - CF t ″ - and in case of refusal from it - CF t ′:

CF t = CF t ′ - CF t ″. (6.1)

The cash flow of the project is defined as incremental, additional cash flow. One of the sources of error is associated with the fact that only in exceptional cases, when the analysis shows that the project does not affect the existing cash flows of the enterprise, this project can be considered in isolation. In most cases, one of the main difficulties in estimating cash flows is to estimate CF t ′ and CF t ″.

Cash flow and accounting. Another source of error is associated with the fact that accounting can combine dissimilar costs and revenues, which are often not identical to the cash flows required for the analysis.

For example, accountants may account for income that is not at all equal to the cash flow, since part of the production is sold on credit. The profit calculation does not deduct capital expenditures, which are cash outflows, but depreciation charges that do not affect cash flow are deducted.

Therefore, when drawing up a capital investment plan, it is necessary to take into account the operating cash flows determined on the basis of the company's cash flow forecast for each year of the analyzed period, subject to the acceptance and rejection of the project. On this basis, the cash flow is calculated in each period:

CF t = [(R 1 - R 0) - (C 1 - C 0) - (D 1- D 0)] × (1 - h) + (D 1 - D 0), (6.2)

where CF t- the balance of the project's cash flow for the period t;

R 1 and R 0- the total inflow of funds of the enterprise in the event of the acceptance of the project and in the event of its rejection;

C 1 and C 0- outflow of funds for the enterprise as a whole in case of acceptance of the project and in case of rejection of it;

D 1 and D 0- the corresponding depreciation charges;

h- income tax rate.

Example. The company is considering a project worth 1,000 thousand rubles. and for a period of 10 years. The annual proceeds from the implementation in the event of the project implementation will amount to 1,600 thousand rubles. per year, and if the company decides to abandon the project - 1000 thousand rubles. in year. Operating costs equivalent to cash flows will amount to 600 and 400 thousand rubles, respectively. per year, depreciation - 200 and 100 thousand rubles. in year. The company will pay income tax at a rate of 34%.

By formula (6.2) we get:

CF t= [(1600 - 1000) - (600 - 400) - (200 - 100)] × (1 - 0.34) + (200 - 100) = 298 thousand rubles.

If the project is implemented during the entire period of its operation, an additional cash flow is expected in the amount of 298 thousand rubles. in year.

Distribution of cash flow over time. In analysis economic efficiency investment must take into account the time value of money. In doing so, it is necessary to find a compromise between accuracy and simplicity. It is often conventionally assumed that a cash flow is a one-time inflow or outflow of funds at the end of the next year. But when analyzing some projects, it is required to calculate cash flow by quarters, months, or even to calculate a continuous flow (the latter case will be discussed below).

Assessment of incremental cash flows is associated with the solution of three specific problems.

Non-refundable expenses are not projected incremental costs and, therefore, should not be taken into account in the capital budget analysis. Irrecoverable expenses are expenses incurred earlier, the amount of which cannot change due to the acceptance or rejection of the project.

For example, an enterprise assessed the feasibility of opening its new production in one of the regions of the country, having spent a certain amount on this. These costs are non-refundable.

Opportunity cost Is the missed possible income from the alternative use of the resource. A correct capital budget analysis should take into account all relevant - significant - opportunity costs.

For example, an enterprise owns a plot of land suitable for a new production facility. The cost of the land should be included in the budget of the project associated with the opening of a new production facility, since if the project is abandoned, the site can be sold and a profit equal to its value minus taxes can be obtained.

Influence on other projects should be factored in when analyzing the capital budget for the project.

For example, the opening of a new production facility in a new region of the country for an enterprise can reduce the sales of existing production facilities - there will be a partial redistribution of customers and profits between the old and new production facilities.

Impact of taxes. Taxes can have a significant impact on the estimate of cash flows and can be decisive in deciding whether a project will go or not. Economists face two challenges:

1) tax legislation is extremely complicated and changes frequently;

2) laws are interpreted in different ways.

Economists can get help from accountants and lawyers in solving these problems, but they need to know the current tax legislation and take into account its impact on cash flows.

Example. The company buys an automatic line for 100,000 rubles, including transportation and installation, and uses it for five years, after which it liquidates it. The cost of production on a line must include a fee for using the line, which is called depreciation.

Since depreciation is deducted from income when calculating profit, an increase in depreciation deductions reduces the balance sheet profit from which income tax is paid. However, depreciation itself does not generate cash outflows, so changes in depreciation do not affect cash flows.

In most cases stipulated by law, the linear depreciation method should be used, in which the amount of annual depreciation deductions is determined by dividing the initial cost, reduced by the amount of the estimated residual value, by the duration of the period of operation of this asset established for this type of property.

For property with a five-year service life, which costs 100,000 rubles. and has a liquidation value of 15,000 rubles, the annual depreciation deductions are (100,000 - 15,000) / 5 = 17,000 rubles. This amount will annually decrease the base for calculating income tax and, on an accrual basis, the base for calculating property tax.

More complex cases of assessing the impact of taxes on the cash flows of investment projects, determined by Russian tax legislation for projects that are innovative, are discussed below.

6.2. Asset substitution, flow valuation bias and management options

Cash flows on asset substitution. A common situation is when it is necessary to make a decision on the advisability of replacing one or another type of capital-intensive assets, for example, such as machinery and equipment.

Example. Ten years ago, a lathe was purchased at a cost of 75,000 rubles. At the time of purchase, the expected service life of the machine was 15 years. At the end of the 15-year life cycle, the residual value of the machine will be zero. The machine is written off using the straight-line depreciation method. Thus, the annual depreciation deductions amount to 5,000 rubles, and its current balance sheet - residual - cost is 25,000 rubles.

The engineers of the departments of the chief technologist and the chief mechanic offered to purchase a new specialized machine for 120,000 rubles. with a 5-year service life. It will reduce labor and raw materials costs so much that operating costs will be reduced from 70,000 to 40,000 rubles. This will lead to an increase in gross profit by 70,000 - 40,000 = 30,000 rubles. in year. It is estimated that in five years a new machine can be sold for 20,000 rubles.

The real market value of the old machine is currently 10,000 rubles, which is lower than its book value. In case of purchasing a new machine, it is advisable to sell the old machine. The corporate tax rate is 40%.

The need for working capital will increase by 10,000 rubles. at the time of replacement.

Since the old equipment will be sold at a price lower than its book - residual - value, the taxable income of the enterprise will decrease by the amount of the loss (15,000 rubles) - the tax savings will be: 15,000 rubles. × 0.40 = 6000 rubles.

Net cash flow at the time of investment will be:

Further calculation of the cash flow is shown in table. 6.1. Having data on the amount of cash flow, it is easy to assess the effectiveness of the investment in question.

Table 6.1. Calculation of the elements of cash flow in case of asset replacement, thousand rubles

Year 0 1 2 3 4 Flows during project implementation

1. Decrease in operating expenses including taxes18 18 18 18 18 2. Depreciation of the new machine 20 20 20 20 20 3. Depreciation of the old machine 5 5 5 5 5 4. Change in depreciation charges 15 15 15 15 15 5. Savings on taxes from changes in depreciation 6 6 6 6 6 6. Net cash flow (1 + 5) 24 24 24 24 24 Streams at the end of the project

7. Forecast of the residual value of the new machine20 8. Tax on income from the disposal of the machine 9. Reimbursement of investments in net working capital 10 10. Cash flow from the operation (7 + 8 + 9) 22 Net cash flow

11. Total net cash flow-114 24 24 24 24 46

Bias in cash flow estimates. Cash flow forecasts in the formation of the capital investment budget are not devoid of bias - distortion of estimates. Managers and engineers tend to be optimistic in their forecasts, as a result, revenues are overestimated, and costs and the level of risk are underestimated.

One of the reasons for this phenomenon is that the salaries of managers often depend on the volume of activities, so they are interested in maximizing the growth of the enterprise at the expense of its profitability. In addition, managers and engineers often overestimate their projects without considering potential negative factors.

To detect bias in the estimate of cash flow, especially for projects that are assessed as highly profitable, it is necessary to determine what constitutes the basis for the profitability of a given project.

If the company has a patent protection, unique production or marketing experience, famous trade mark and so on, then projects that take advantage of this advantage can indeed become extraordinarily profitable.

If there is a possibility of the threat of increased competition in the implementation of the project and if managers cannot find any unique factors that could support the high profitability of the project, then the enterprise management should consider the problems of estimation bias and seek its clarification.

Management (real) options. Another problem is the underestimation of the real profitability of the project as a result of underestimation of its value, expressed in the emergence of new management capabilities (options).

Many investment projects are potentially inherent in new opportunities, the implementation of which was impossible earlier - for example, the development of new products in the direction of the launched project, the expansion of product markets, the expansion or re-equipment of production, the termination of the project.

Moreover, some management capabilities are of strategic importance, since they involve the development of new types of products and sales markets. Since emerging management opportunities are many and varied, and the timing of their implementation is uncertain, they are often not included in the estimate of the project's cash flows. This is unacceptable as this practice leads to incorrect project evaluation.

Real NPV the project must be presented as the sum of the traditional NPV calculated by the method DCF, and the value of the management options included in the project:

real NPV = traditional NPV + management options cost.

Various peer review methods can be used to assess the value of management options, but care should be taken to ensure that the experts involved have a high level of professional competence.

Real NPV it can often be many times superior to the traditional one due to the contribution of managerial options, which are sometimes called real options.

6.3. Unequal projects, project terminations, inflation accounting

Evaluation of projects with unequal duration is based on the use of the following methods:

- chain repeat method;

- equivalent annuity method.

Example. The enterprise plans to modernize production transport and may opt for a conveyor system (project A) or on a fleet of forklift trucks (project V). Table 6.2 shows the expected net cash flows and NPV alternative options.

Table 6.2. Expected cash flows for alternative projects, thousand rubles

Year Project A Project B Project B with repeat 0 -40 000 -20 000 -20 000 1 8000 7000 7000 2 14 000 13 000 13 000 3 13 000 12 000 12 000 - 20 000 = - 8000 4 12 000 — 7000 5 11 000 — 13 000 6 10 000 — 12 000 NPV at 11.5% 7165 5391 9281 IRR, % 17,5 25,2 25,2 It can be seen that the project A at a discount rate of 11.5%, equal to the price of capital, has more high value NPV and therefore, at first glance, is preferable. Though IRR the project V above based on the criterion NPV, you can still consider the project A the best. But this conclusion must be questioned due to the varying duration of the projects.

Chain repeat method(total validity period). When choosing a project V it becomes possible to repeat it in three years, and if costs and revenues remain at the same level, the second implementation will be just as profitable. Then the timing of the implementation of both project options will coincide. This is the chain repeat method.

It includes the definition NPV the project V realized twice in a 6-year period, and then comparing the total NPV c NPV the project A over the same six years.

Repetition data V are also given in table. 6.2. By criterion NPV project B turns out to be clearly preferable, as by the criterion IRR, which does not depend on the number of repetitions.

In practice, the described method can turn out to be very time-consuming, since multiple repetitions of each of the projects may be required to get the timing match.

Equivalent annuity method (Equivalent Annual Annuity - EAA) Is an estimation method that can be applied regardless of whether the duration of one project is a multiple of the duration of another project, as is necessary for the rational application of the chain repetition method. The considered method includes three stages:

1) is NPV each of the compared projects for the case of a one-time implementation;

2) there are urgent annuities, the price of which is NPV flow of each project. For this example, using the financial function of tables Excel or tables from the Appendix we find for the project B fixed-term annuity with a price equal to NPV the project B, the price of which is 5 391 thousand rubles. The corresponding fixed-term annuity will be EAA B= 22 250 thousand rubles. Similarly, we define for the project A: EAA A= 17 180 thousand rubles;

3) we believe that each project can be repeated an infinite number of times - go to perpetual annuities. Their prices can be found using the well-known formula: NPV = EAA / a... Thus, with an infinite number of repetitions NPV threads will be equal:

NPV A ∞= 17 180 / 0.115 = 149 390 thousand rubles,

NPV B ∞= 22 250 / 0.115 = 193 480 thousand rubles.

Comparing the data obtained, one can draw the same conclusion - the project V more preferred.

The financial result of the termination of the project. Often a situation arises when an enterprise is more profitable early termination the project, which, in turn, can significantly affect its forecast efficiency.

Example. Table data. 6.3 can be used to illustrate the concept of the financial result of project termination and its impact on the formation of the capital budget. The financial result of the discontinuation of the project is numerically equivalent to the net salvage value, with the difference that it is calculated for each year of the project life.

With a capital price of 10% and the full duration of the project NPV= -177 thousand rubles the project should be rejected.

Let's analyze another possibility - early termination of the project after two years of its operation. In this case, in addition to operating income, additional income will be received in the amount of the residual value. In case of project liquidation at the end of the second year NPV= -4800 + 2000 / 1.1 1 + 1875 / 1.1 2 + 1900 / 1.1 2 = 138 thousand rubles.

A project is acceptable if it is planned to operate it for two years and then abandon it.

Accounting for inflation. If all costs and selling price are expected, and therefore annual cash flows, will increase at the same rate as general level inflation, which is also taken into account in the price of capital, then NPV adjusted for inflation will be identical NPV excluding inflation.

There are often cases when the analysis is performed in monetary units of constant purchasing power, but taking into account the market price of capital. This is a mistake, because the price of capital usually includes inflationary premium, and using a “constant” currency to estimate cash flow will underestimate it. NPV(in the denominators of the formulas there is an inflation adjustment, but in the numerators it is not).

The impact of inflation can be taken into account in two ways.

First method - forecasting cash flow without adjusting for inflation; accordingly, the inflationary premium is also excluded from the capital price.

This method is simple, but it requires inflation to affect all cash flows and depreciation in the same way, and that the inflation adjustment included in the return on equity is consistent with the inflation rate. In practice, these assumptions are not realized; therefore, the use of this method in most cases is unjustified.

According to second(more preferable) way, the capital price is kept nominal, and then the individual cash flows are adjusted for inflation rates by specific markets... Since it is impossible to accurately estimate future inflation rates, errors are inevitable even when using this method, therefore, the degree of risk of capital investments in conditions of inflation increases.

6.4. Risk associated with the project

Risk characteristics. When analyzing investment projects, three types of risks are distinguished:

1) a single risk, when the risk of a project is considered in isolation, out of connection with other projects of the enterprise;

2) intracompany risk, when the project risk is considered in its relation to the portfolio of projects of the enterprise;

3) market risk, when the risk of a project is considered in the context of diversification of the capital of shareholders of an enterprise in the stock market.

The logic of the process for quantifying various risks is based on taking into account a number of circumstances:

1) risk characterizes the uncertainty of future events. For some projects, it is possible to process statistical data from past years and analyze the riskiness of investments. However, there are cases when it is impossible to obtain statistics on the proposed investments and one has to rely on the estimates of experts - managers and specialists. Therefore, it should be borne in mind that some of the data used in the analysis is inevitably based on subjective assessments;

2) in the analysis of risk, various indicators and special terms are used, which were given earlier:

σ P- the standard deviation of the profitability of the project under consideration, defined as the standard deviation of the internal profitability (IRR) project, σ P- indicator of a single project risk;

r P, F- the coefficient of correlation between the profitability of the analyzed project and the profitability of other assets of the enterprise;

r P, M- the coefficient of correlation between the profitability of the project and the profitability on the stock market on average. This relationship is usually assessed on the basis of subjective expert judgments. If the value of the coefficient is positive, then the project, under a normal situation in a growing economy, will tend to have a high profitability;

σ F- the standard deviation of the profitability of the assets of the enterprise before the acceptance for execution of the project under consideration. If σ F is small, the enterprise is stable and its corporate risk is relatively low. Otherwise, the risk is high and the chances of bankruptcy of the enterprise are high;

σ M Is the standard deviation of the market yield. This value is determined on the basis of data from previous years;

β P, F- in-house β-coefficient. Conceptually, it is determined by regressing the profitability of the project relative to the profitability of the enterprise, excluding the given project. To calculate the intra-company coefficient, you can use the formula given earlier:

β P, F = (σ P / σ F) × r P, F ;

β P, M- β-coefficient of the project in the context of the market portfolio of shares; theoretically it can be calculated by regressing the project's profitability relative to the profitability in the market. It can be expressed by a formula similar to the formula for β P, F... This is the project's market β-coefficient. It is a measure of the project's contribution to the risk to which the shareholders of the enterprise are exposed;

3) when assessing the riskiness of a project, it is especially important to measure its unit risk - σ P, since when forming the capital investment budget, this component is used at all stages of the analysis, depending on what they want to measure - corporate risk, market risk, or both types of risk;

4) most of the projects have a positive correlation coefficient with other assets of the enterprise, and its value is the highest for projects that relate to the main area of the enterprise. The correlation coefficient is rarely +1.0, therefore, some part of the unit risk of most projects will be eliminated by diversification, and the larger the enterprise, the more likely this effect is. The intracompany project risk is less than its single risk;

5) most of the projects, in addition, positively correlate with other assets in the country's economy;

6) if in-house β P, F of the project is 1.0, then the degree of corporate risk of the project is equal to the degree of risk of the average project. If β P, M more than 1.0, then the project risk is greater than the average corporate risk, and vice versa. Risk exceeding the corporate average usually leads to the use of the weighted average price of capital (WACC) above average, and vice versa. Clarification WACC in this case, it is carried out for reasons of common sense;

7) if the in-house β-coefficient is β P, M of the project is equal to the market beta of the enterprise, then the project has the same degree of market risk as the average project. If β P, M of the project is greater than the beta of the enterprise, then the project risk is greater than the average market risk, and vice versa. If the market beta is higher than the enterprise's average market beta, this will usually involve using the weighted average cost of capital. (WACC) above average, and vice versa. To be sure WACC in this case, you can use the model for assessing the profitability of financial assets (CAPM);

8) there are often statements that the single or intra-company risks defined above do not matter. If an enterprise seeks to maximize the wealth of its owners, then the only significant risk is market risk. This is incorrect for the following reasons:

- small business owners and shareholders whose stock portfolios are not diversified are more concerned with corporate risk than market risk;

- investors with a diversified portfolio of shares, when determining the required return, in addition to market risk, take into account other factors, including the risk of a financial downturn, which depends on the intra-company risk of the enterprise;

- the stability of the enterprise is important for its managers, employees, customers, suppliers, creditors, representatives of the social sphere, who are not inclined to deal with unstable enterprises; this, in turn, makes it difficult for businesses to operate and, consequently, reduces profitability and share prices.

6.5. Single and intracompany risks

Analysis single risk The project begins with the establishment of the uncertainty inherent in the project's cash flows, which can be based on a simple expression of the opinions of specialists and managers as experts, and on complex economic and statistical studies using computer models... The most commonly used analysis methods are:

1) sensitivity analysis;

2) scenario analysis;

3) simulation modeling by the Monte Carlo method.

Sensitivity analysis- shows exactly how much will change NPV and IRR of the project in response to a change in one input variable with all other conditions unchanged.

Sensitivity analysis begins by constructing a base case, developed from the expected values of the input quantities, and calculating the quantities. NPV and IRR for him. Then, through calculations, answers are obtained to a series of “what if?” Questions:

- what if the volume of sales in physical units falls or rises from the expected level, for example, by 20%?

- what if selling prices fall by 20%?

- what if the cost per unit of goods sold falls or rises, for example, by 20%?

When performing a sensitivity analysis, each variable is usually changed repeatedly, increasing or decreasing its expected value in a certain proportion and leaving other factors constant. Each time the values are calculated NPV and other indicators of the project, and, finally, on their basis, graphs of their dependence on the variable variable are built.

The slope of the graph lines shows the degree of sensitivity of the project indicators to changes in each variable: the steeper the slope, the more sensitive the project indicators to the change in the variable, the more risky the project is. V comparative analysis a project that is sensitive to change is considered more risky.

Analysis of scenarios. The unit risk of a project depends on the sensitivity of its NPV to changes in the most important variables and from the range of probable values of these variables. Risk analysis that treats as sensitivity NPV changes in critical variables and the range of likely values of variables is called scenario analysis.

When using it, the analyst must obtain from the project manager an estimate of the set of conditions (for example, sales volume in natural units, sales price, variable costs per unit of production) according to the worst, average (most probable) and best options, as well as estimates of their likelihood. Often a 0.25 or 25% probability is recommended for the worst and best options, and 50% for the most probable.

Then calculate NPV according to options, its expected value, standard deviation and coefficient of variation - iota coefficient characterizing the unit risk of the project. For this, formulas similar to formulas (2.1) - (2.4) are used.

Sometimes they try to take into account the diversity of events more fully and give an estimate for five variants of events (see the example given in paragraph 2.5 of Chapter 2).

Monte Carlo simulation requires not complicated, but special software, while the calculations associated with the methods discussed above can be performed using the programs of any electronic office.

The first stage of computer modeling is to define the probability distribution for each input variable of the cash flow, for example, price and volume of sales. For this purpose, continuous distributions are usually used, completely specified by a small number of parameters, for example, they set the mean and standard deviation or the lower limit, the most probable value, and the upper limit of the variable feature.

The actual modeling process is carried out as follows:

1) the simulation program randomly selects a value for each input variable, for example, for volume and selling price, based on its given probability distribution;

2) the value chosen for each variable variable, together with specified values for other factors (such as tax rate and depreciation charges), is then used to determine the net cash flows for each year; after that it is calculated NPV the project in this cycle of calculations;

3) steps 1 and 2 are repeated many times - for example 1000 times, which gives 1000th values NPV, which will compose the probability distribution over which the expected values are calculated NPV and its standard deviation.

Intercompany risk- this is the contribution of the project to the total aggregate risk of the enterprise, or, in other words, the impact of the project on the variability of the total cash flows of the enterprise.

It is known that the most relevant (significant) type of risk, from the point of view of managers, employees, creditors and suppliers, is intra-company risk, while for well-diversified shareholders, the most relevant is the market risk of the project.

Once again, we draw attention to the fact that the intra-company risk of the project is the contribution of the project to the total aggregate risk of the enterprise, or to the volatility of the consolidated cash flows of the enterprise. Intercompany risk is a function of both the standard deviation of project revenues and its correlation with revenues from other assets of the enterprise. Therefore, a design with a high standard deviation will likely have a relatively low in-house(corporate) risk if its returns are not correlated or negatively correlated with returns from other assets of the enterprise.

In theory, intracompany risk fits into the concept of a characteristic line. Recall that the characteristic line reflects the relationship between the return on an asset and the return on a portfolio that includes the totality of all stocks on the stock market. The slope of the line is the β-coefficient, which is an indicator of the market risk of a given asset.

If we consider the enterprise as a portfolio of individual assets, then we can consider the characteristic line of the dependence of the profitability of the project on the profitability of the enterprise as a whole, determined by the income of its individual assets, with the exception of the project being evaluated. In this case, the profitability is calculated according to accounting data - accounting data, the method of using which will be explained below, since it is impossible to determine profitability in a market sense for individual projects.

The slope of such a characteristic line is numerically expressed by the β value of the project's intracompany risk.

A project with a β value of intra-firm risk equal to 1.0 will be risky just as much as the average enterprise asset will be risky. A project with an intracompany risk β exceeding 1.0 will be more risky than the average enterprise asset; a project with β of intracompany risk less than 1.0 will be less risky than the average enterprise asset.

β of the intracompany project risk can be defined as

where σ P- standard deviation of the project profitability;

σ F- the standard deviation of the profitability of the enterprise;

r P, F- the coefficient of correlation between the profitability of the project and the profitability of the enterprise.

Comparatively high value project σ P and r P, F will have a greater intra-firm risk than a project with low values of these indicators.

If the profitability of the project is negatively correlated with the profitability of the enterprise as a whole, a high value of st P is preferable, since the more σ P, the greater the absolute value of negative β of the project, therefore, the lower the intra-company risk of the project.

In practice, it is rather difficult to predict the probability distribution of the profitability of an individual project, but it is possible. For the enterprise as a whole, obtaining data on the distribution of the probability of profitability usually does not cause difficulties. But it is difficult to assess the correlation coefficient between the profitability of the project and the profitability of the enterprise. For this reason, the transition from a single project risk to its intracompany risk in practice is often carried out subjectively and simplified.

If a new project is related to the main activity of the enterprise, which is usually the case, then a high single risk of such a project also means a high intra-company risk of the project, since the correlation coefficient will be close to one. If the project does not correspond to the main activity of the enterprise, then the correlation may be low and the intra-company risk of the project will be less than its single risk. The calculation methodology based on this approach is given below.

6.6. Market risk

The influence of capital structure. The beta coefficient, which characterizes the market risk of an enterprise that finances its activities exclusively from its own funds, is called independent beta - β U... If the company begins to attract borrowed funds, the riskiness of its equity capital, as well as the value of its now dependent beta coefficient - β L will increase.

To estimate β L R. Hamada's formula can be used, expressing the interdependence between the above indicators:

β L = β U - , (6.3)

where h- income tax rate;

D and S- market estimates of the company's debt and equity capital, respectively.

Obtaining market estimates of the company's debt and equity capital was discussed in the previous chapters, including the example of the application of options theory.

If the analysis considers a single-product enterprise independent of creditors, then its β U represents the β-ratio of a single asset. β U can be considered the β-coefficient of an asset independent in terms of funding.

β U enterprise with one asset is a function of the production risk of the asset, the indicator of which is β U, as well as the method of financing the asset. The approximate value of β U can be expressed using the transformed Hamada formula:

β U = β L / . (6.4)

Assessment of the market risk of a project using the pure play method. In accordance with this method, attempts are made to identify one or more independent single-product enterprises specializing in the field to which the assessed project belongs. Then, using the statistical data, the values of the β-coefficients of these enterprises are calculated by means of regression analysis, they are averaged and this average is used as the β-coefficient of the project.

Example. Suppose the profitability of the company's shares a M = 13%, D / S= 1.00 and h= 46%; risk-free profitability in the securities market a RF= 8%, the cost of borrowed capital for the enterprise a d = 10%.

An economist-analyst of the enterprise, evaluating the project, the essence of which is the creation of a PC production, identified three open joint-stock companies engaged exclusively in the production of PCs. Let the average value of the β-coefficients of these enterprises be 2.23; the average D / S- 0.67; average rate h- 36%. The general evaluation algorithm is as follows:

1) the mean values of β (2.23) are identified, D / S(0.67) and h(36%) representative enterprises;

2) according to the formula (6.4), we calculate the value of p of the functioning assets of the representative enterprises:

β U = 2,23 / = 1,56;

3) using formula (6.3), we calculate β assets of representative enterprises, provided that these enterprises have the same capital structure and tax rate as the enterprise under consideration:

β L= 1.56 × = 2.50;

4) using the model for assessing the profitability of financial assets (SARM), we determine the price of equity capital for the project:

a si =a RF + (a M × a RF) × β i= 8% + (13% - 8%) × 2.50 = 20.5%;

5) using data on the capital structure of the enterprise, we determine

weighted average cost of capital for a computer project:WASS = w d × a d× (1 - h) + w s × a s= 0.5 × 10% × 0.60 + 0.5 × 20.5% = 13.25%.

The pure play method is not always applicable because it is not easy to identify businesses that are suitable for benchmarking.

Another difficulty is the need to have not balance sheet, but market estimates of the components of the capital of enterprises, while in Russian system accounting records are still based solely on historical rather than market estimates.

Market risk assessment using the accounting β method... Beta ratios are usually determined by regressing the stock returns of a given stock company against the stock market index returns. But you can get a regression equation for the profitability of an enterprise (profit before interest and taxes divided by the amount of assets) relative to the average of this indicator for a large sample of enterprises. Determined on this basis (using accounting data rather than stock market data) beta factors are called accounting β-factors.

Accounting β can be calculated based on historical data for all types of enterprises - open and closed joint-stock companies, private, non-profit organizations, as well as for large projects. However, it should be borne in mind that they provide only a rough estimate of the market β.

6.7. Accounting for risk and cost of capital when adopting a capital budget

Risk-Free Equivalent Method directly due to the concept of the theory of utility. According to this method, the decision-maker must first assess the risk of cash flow and then determine how much guaranteed amount of money would be required to be indifferent to the choice between this risk-free amount and the risk expected amount of cash flow. The idea of a risk-free equivalent is used in the decision-making process when forming the capital investment budget:

1) for each year, the degree of risk of the element of the cash flow of a particular project and the amount of its risk-free equivalent are assessed CE t.

For example, in the third year of the project, a cash flow of 1,000 thousand rubles is expected, the risk level is assessed as medium; the decision maker considers that the risk-free equivalent CF 3 should amount to 600 thousand rubles;

2) calculated NPV equivalent risk-free cash flow at a risk-free discount rate:

![]() , (6.5)

, (6.5)

If the value NPV, defined in this way positively, then the project can be accepted.

Risk-adjusted discount rate method, does not imply a cash flow adjustment, but a risk adjustment is introduced into the discount rate.

For example, an entity evaluating a project has WACC= 15%. Therefore, all projects of medium risk, financed in compliance with the target capital structure of the enterprise, are valued at a discount rate of 15%.

If the project in question is classified as more risky than the average project of the enterprise, then a higher discount rate is set for it, for example, 20%. In this case, the calculated value NPV the project will naturally decline.

In order for the use of both considered methods to lead to the same value NPV, it is necessary that the discounted flow elements be equal to each other.

Financial and economic activities of the enterprise can be presented in the form of a cash flow characterizing the income and expenses generated by this activity. Making decisions related to capital investment is an important stage in the activities of any enterprise. To effectively use the funds raised and maximize the return on invested capital, a thorough analysis of future cash flows associated with the sale is required. developed operations, plans and projects.

Cash flow estimation carried out by discount methods, taking into account the concept of the time value of money.

The task of the financial manager is to select such projects and ways of their implementation that will provide a cash flow that has the maximum present value in comparison with the amount of required capital investment.

Investment project analysis

There are several methods for assessing the attractiveness of investment projects and, accordingly, several main indicators of the efficiency of cash flows generated by projects. Each method is based on the same principle: as a result of the implementation of the project, the enterprise should make a profit(the company's own capital should increase), while various financial indicators characterize the project with different sides and may meet the interests of various groups of persons related to this enterprise (owners, creditors, investors, managers).

The first stage analyzing the effectiveness of any investment project - calculating the required capital investments and forecasting the future cash flow generated by this project.

The basis for calculating all indicators of the effectiveness of investment projects is the calculation net cash flow, which is defined as the difference between current income (inflow) and expenses (outflow) associated with the implementation of the investment project and measured by the number of monetary units per unit of time (monetary unit / time unit).

In most cases, capital investments occur at the beginning of the project at the zero stage or during the first few periods, and then the cash inflow follows.

From a financial point of view, the flows of current income and expenses, as well as the net cash flow, fully characterize the investment project.

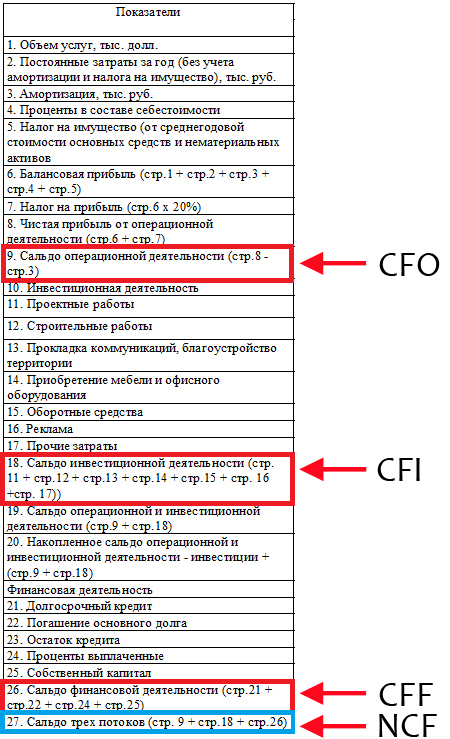

Cash flow forecasting

When forecasting cash flow, it is advisable to forecast the data of the first year with a breakdown by months, the second year - by quarters, and for all subsequent years - by the total annual values. This scheme is recommended and in practice should correspond to the conditions of a particular production.

A cash flow for which all negative elements precede positive ones is called standard(classic, normal, etc.). For non-standard flow alternation of positive and negative elements is possible. In practice, such situations are most often encountered when the completion of a project requires significant costs (for example, dismantling equipment). Additional investments may also be required in the process of project implementation related to environmental protection measures.

The advantages of using cash flows when assessing the effectiveness of the financial and investment activities of an enterprise:

cash flows exactly correspond to the theory of the value of money in time - the basic concept of financial management;

cash flows are a well-defined event;

using real cash flows avoids the problems associated with memorial accounting.

When calculating cash flows, one should take into account all those cash flows that change thanks to this solution:

changes in the amount of working capital;

the opportunity cost of using the scarce resources that are available to the firm (although this does not have to directly, directly correspond to the cash expenditure).

costs associated with production (building, equipment and fittings);

changes in receipts, income and payments;

Should not be taken into account those cash flows that do not change in connection with the adoption of this investment decision:

past cash flows (costs incurred);

cash flows in the form of costs that would be incurred regardless of whether the investment project would be implemented or not.

There are two types of costs that make up the total capital investment required.

Immediate costs necessary to launch a project (construction of buildings, purchase and installation of equipment, investment in working capital, etc.).

Opportunity costs. Most often, this is the cost of the premises or land plots used, which could have been profitable in another operation (alternative income) if they had not been employed for the implementation of the project.

When predicting future cash flow, it should be borne in mind that reimbursement of costs associated with the necessary increase in the working capital of the enterprise (cash, inventory or receivables) occurs at the end of the project and increases the positive cash flow relating to the last period.

The final result of each period, which forms the future cash flow, is the amount of net profit, increased by the amount of accrued depreciation and accrued interest on borrowed funds (interest has already been taken into account when calculating the cost of capital and should not be counted twice).

In general terms, the cash flow generated by an investment project is a sequence of elements INV t , CF k

INV t - negative values corresponding to cash outflows (for this period, the total costs of the project exceed the total income);

CF k - positive values corresponding to cash inflows (incomes exceed expenses).

Since the planning of future cash flow is always carried out in conditions of uncertainty (it is necessary to forecast future prices for raw materials, interest rates, taxes, wages, sales volume, etc.), it is advisable to consider at least three possible implementation options to take into account the risk factor - pessimistic, optimistic and the most realistic. The smaller the difference in the resulting financial indicators for each option, the more stable this project changes in external conditions, the lower the risk associated with the project.

Key indicators related to the assessment of cash flow

An important step in assessing cash flows is analysis of the financial capabilities of the enterprise, the result of which should be the value of the cost of capital of the enterprise for different volumes of required investment.

WACC value is the basis for making financial and investment decisions, since in order to increase the capital of an enterprise, the following conditions must be met: the cost of capital is less than the return on its investment.

The value of the weighted average cost of capital WACC in most cases is chosen as the discount rate when assessing future cash flows. If necessary, it can be adjusted for indicators of the possible risk associated with the implementation of a specific project and the expected inflation rate.

If the calculation of the WACC indicator is associated with difficulties that raise doubts about the reliability of the result (for example, when assessing equity capital), you can choose the value of the average market return adjusted for the risk of the analyzed project as the discount rate.

In some cases, the value of the discount rate is taken equal to the indicator refinancing rates The Central Bank.

Payback period of the investment project

Calculation of the payback period is often the first step in the process of deciding whether a particular investment project is attractive for an enterprise. This method it can also be used for quick rejection of projects that are unacceptable from the point of view of liquidity.

Most of all, creditors of the enterprise are interested in calculating this indicator, for whom the earliest payback is one of the guarantees of the return of the funds provided.

In the general case, the sought value is the value !! DPP ??, for which !! DPP = min N ??, at which ∑ INV t / (1 + d) t more or equal ∑ CF k / (1 + d) k, where is the discount rate.

The criterion for making a decision when using the method for calculating the payback period can be formulated in two ways:

the project is accepted if the payback in general takes place;

the project is accepted if the found DPP value lies within the specified limits. This option is always used when analyzing projects with a high degree of risk.

When choosing projects from several possible options projects with a shorter payback period will be preferable.

Obviously, the higher the discount rate, the higher the value of the payback period.

A significant disadvantage of this indicator as a criterion for the attractiveness of the project is ignoring positive values of cash flow beyond the calculated period . As a result, a project that as a whole would bring more arrived enterprise for the entire period of implementation, may turn out to be less attractive according to the criterion !! DPP ?? compared to another project that brings a much lower final profit, but quickly recovers the initial costs. (By the way, this circumstance does not bother the creditors of the enterprise at all.)

This method also does not distinguish between projects with the same !! DPP ?? value, but with different income distributions within the calculated period. Thus, the principle of the time value of money is partially ignored when choosing the most preferable project.

Net present (discounted) income

NPV indicator reflects a direct increase in the company's capital, therefore, for the shareholders of the enterprise, it is the most significant. The calculation of the net present value is carried out according to the following formula:

NPV = ∑ CF k / (1 + d) k - ∑ INV t / (1 + d) t .

The criterion for the acceptance of the project is a positive NPV. In the case when it is necessary to make a choice from several possible projects, preference should be given to the project with a higher net present value.

It should be borne in mind that the ratio of NPV indicators of various projects is not invariant with respect to changes in the discount rate. A project that was more preferable according to the NPV criterion for one value of the rate may turn out to be less preferable for another value. It also follows from this that the PP and NPV indicators can give conflicting estimates when choosing the most preferable investment project.

For informed decision-making and taking into account possible changes in the rate (usually corresponding to the cost of the invested capital), it is useful to analyze the graph of the dependence of NPV on d. For standard cash flows, the NPV curve is monotonically decreasing, tending with increasing d to a negative value equal to the reduced value of the invested funds (∑ INV t / (1 + d) t). The slope of the tangent at a given point on the curve reflects the sensitivity of the NPV to a change in d. The greater the angle of inclination, the more risky the project is: a slight change in the market situation that affects the discount rate can lead to serious changes in the projected results.

For projects with large incomes during the initial periods of implementation, possible changes in net present value will be less (obviously, such projects are less risky, since the return on investment is faster).

When comparing two alternative projects, it is advisable to determine the value barrier rates at which the indicators of the net present value of the two projects are equal. The difference between the discount rate used and the barrier rate will represent a margin of safety in terms of the advantage of a high NPV project. If this difference is small, then an error in the choice of the rate d can lead to the fact that a project will be accepted for implementation, which in reality is less profitable for the enterprise.

Internal rate of return

The internal rate of return corresponds to the discount rate at which the present value of the future cash flow coincides with the value of the invested funds, i.e., it satisfies the equality

∑ CF k / (1 + IRR) k = ∑ INV t / (1 + IRR) t .

Finding this indicator without the help of special tools (financial calculators, computer programs) generally implies solving an equation of degree n, therefore it is rather difficult.

To find the IRR corresponding to normal cash flow, you can use the graphical method, given that the NPV value turns to 0 if the discount rate matches the IRR value (this is easy to see by comparing the formulas for calculating NPV and IRR). This fact is the basis for the so-called graphical method for determining IRR, which corresponds to the following formula for approximate calculation:

IRR = d 1 + NPV 1 (d 2 - d 1 ) / (NPV 1 - NPV 2 ) ,

where d 1 and d 2 are rates corresponding to some positive (NPV 1) and negative (NPV 2) values of net present value. The smaller the interval d 1 - d 2, the more accurate the result obtained. For practical purposes, a 5 percentage point difference can be considered sufficient to obtain a reasonably accurate IRR value.

The criterion for accepting an investment project is the excess of the IRR of the selected discount rate. When comparing multiple projects, projects with higher IRR values are preferable.

In the case of normal (standard) cash flow, the condition IRR> d is fulfilled simultaneously with the condition NPV> 0. Decision-making based on the NPV and IRR criteria gives the same results if the question of the possibility of implementing a single project is considered. If several different projects are compared, these criteria may give conflicting results. It is believed that in this case, the priority will be the indicator of net present value, since, reflecting the increase in the company's equity capital, it is more in the interests of shareholders.

Modified Internal Rate of Return

For non-standard cash flows, the solution of the equation corresponding to the definition of the internal rate of return in the overwhelming majority of cases (non-standard flows with a single IRR value are possible) gives several positive roots, that is, several possible values of the IRR indicator. In this case, the criterion IRR> d does not work: the IRR value may exceed the used discount rate, and the project under consideration turns out to be unprofitable.

To solve this problem, in the case of non-standard cash flows, an analogue of IRR is calculated - a modified internal rate of return MIRR (it can also be calculated for projects that generate standard cash flows).

MIRR is the interest rate at which, during the project implementation period n, the total amount of all investments discounted at the initial moment is increased, the value is equal to the sum of all cash inflows accumulated at the same rate d at the moment of the project completion:

(1 + MIRR) n ∑ INV / (1 + d) t = ∑ CF k (1 + d) n-k .

Decision criterion MIRR> d. The result is always consistent with the NPV criterion and can be used to estimate both standard and non-standard cash flows.

Rate of return and profitability index

Profitability is an important indicator of investment efficiency, since it reflects the ratio of costs and incomes, showing the amount of income received for each unit (ruble, dollar, etc.) invested.

P = NPV / INV 100%.

The profitability index (profitability ratio) PI - the ratio of the present value of the project to the costs, shows how many times the invested capital will increase during the implementation of the project:

PI = [∑ CF k / (1 + d) k ] / INV = P / 100% + 1.

The criterion for making a positive decision when using profitability indicators is the ratio P> 0 or, which is the same, PI> 1. Of several projects, those with higher profitability indicators are preferable.

The criterion of profitability can give results that contradict the criterion of net present value if projects with different amounts of invested capital are considered. When making a decision, it is necessary to take into account the financial and investment opportunities of the enterprise, as well as the consideration that the NPV indicator is more in the interests of shareholders in terms of increasing their capital.

At the same time, it is necessary to take into account the influence of the projects under consideration on each other, if some of them can be accepted for implementation at the same time and on projects already being implemented by the enterprise. For example, the opening of a new production facility may lead to a decrease in the volume of sales of previously produced products. Two projects, implemented simultaneously, can give a result and more (synergy effect) and less than in the case of a separate implementation.

Summing up the analysis of the main indicators of cash flow efficiency, the following important points can be highlighted.

Advantages of the PP method (a simple method for calculating the payback period):

simplicity of calculations;

accounting for the liquidity of the project.

Cutting off the most dubious and risky projects, in which the main cash flows fall at the end of the period, the PP method is used as a simple method for assessing investment risk.

It is convenient for small firms with a small cash turnover, as well as for express analysis of projects in conditions of a lack of resources.

Disadvantages of the PP method:

the choice of the barrier value for the payback period can be subjective;

the profitability of the project outside the payback period is not taken into account. The method cannot be applied when comparing options with the same payback periods, but different lifetimes;

the time value of money is not taken into account;

not suitable for evaluating projects related to fundamentally new products;

the accuracy of calculations using this method largely depends on the frequency of dividing the life of the project into planning intervals.

Benefits of the DPP method:

takes into account the time aspect of the value of money, gives a longer payback period than PP, and takes into account more cash flows from investments;

has a clear criterion for the acceptability of projects. When using DPP, a project is accepted if it pays for itself during its lifetime;

the liquidity of the project is taken into account.

The method is best used for quickly rejecting low-liquid and high-risk projects in an environment of high inflation.

Disadvantages of the DPP method:

does not take into account all cash flows that come after the end of the project. But, since DPP is always greater than PP, then DPP excludes less of these receipts.

Benefits of the NPV method:

is focused on increasing the well-being of investors, therefore, it is fully consistent with the main goal of financial management;

takes into account the time value of money.

Disadvantages of NPV method:

with different initial costs with the same amount of net present;

with a higher net present value and a long payback period and projects with a lower net present value and a short payback period;

it is difficult to objectively assess the required rate of return. Its choice is a defining moment in the analysis of NPV, since it determines the relative value of cash flows falling over different periods of time. The rate used in estimating NPV should reflect the required risk-adjusted rate of return;

it is difficult to assess such uncertain parameters as moral and physical deterioration of fixed capital; changes in the activities of the organization. This can lead to an incorrect estimate of the life of fixed assets;

NPV value does not adequately reflect the result when comparing projects:

may produce conflicting results with other cash flow measures.

The method is most often used when approving or rejecting a single investment project. It is also used in the analysis of projects with uneven cash flows to assess the value of the internal rate of return of the project.

The advantages of the IRR method:

objectivity, information content, independence from the absolute size of the investment;

gives an estimate of the relative profitability of the project;

can easily be adapted to compare projects with different levels of risk: projects with a high level of risk must have a large internal rate of return;

does not depend on the selected discount rate.

Disadvantages of the IRR method:

the complexity of the calculations;

possible subjectivity of the choice of the normative return;

high dependence on the accuracy of estimates of future cash flows;

implies the mandatory reinvestment of all income received, at a rate equal to IRR, for a period until the end of the project;

not applicable to measure non-standard cash flows.

The most frequently used method, due to the visibility of the results obtained and the possibility of their comparison with the value of the profitability of various market financial instruments, is often used in combination with the payback period method.

The advantages of the MIRR method:

gives a more objective assessment of the return on investment;

rarely conflicts with the NPV criterion;

Disadvantages of the MIRR method:

depends on the discount rate.

The MIRR method is used in the same cases as the IRR method when there are uneven (non-standard) cash flows causing the problem of multiple IRRs.

Advantages of the P and PI method:

the only one of all indicators reflects the ratio of income and costs;

gives an objective assessment of the profitability of the project;

is applicable to estimate any cash flows.

Disadvantages of the P and PI method:

may give conflicting results with other indicators.

The method is used when the payback method and the NPV (IRR) method give conflicting results, as well as if the value of the initial investment is important for investors.

Analysis of criteria for the effectiveness of investment projects. Comparison of NPV and IRR.

If the NPV and IRR criteria are applied to a single project in which there are only cash receipts after the initial cash expenditure, then the results obtained using both methods are consistent with each other and lead to identical decisions.

For projects with different calendar schedules of cash flows, the value of the internal rate of return (IRR) can be as follows:

a project in which there is no cash expenditure always has a positive NPV; therefore, there is no IRR in the project (where NPV = 0). In this case, you should abandon IRR and use NPV. Since NPV> 0, this project should be accepted;

a project in which there is no cash flow always has a negative NPV, and in such a project there is no IRR. In this case, you should abandon IRR and use NPV; since NPV< 0, то данный проект следует отвергнуть;

no IRR:

opposite IRR. A project in which cash comes in first and then is spent has an IRR that is never consistent with NPV (low IRR and positive NPV will be observed simultaneously);

multiple IRRs. A project in which there are alternating occurrences of cash in and then out will have as many values of the internal rate of return as there are changes in the direction of cash flows.

3. Ranking of projects is necessary if:

projects are alternative in order to be able to choose one of them;

capital is limited and the firm is unable to raise enough capital for the implementation of all good projects;

there is no agreement between NPV and IRR. When two methods are used simultaneously: NPV and IRR, different rankings often arise.

Reasons for inconsistency between IRR and NPV results for several projects

Project lead time - those projects that are implemented for a long time may have a low internal rate of return, but over time their net present value may be higher than that of short-term projects with a high rate of return.

Choosing between IRR and NPV:

if we use the NPV method as a criterion for choosing an investment project, then it leads to the maximization of the amount of cash, which is equivalent to the maximization of value. If this is the purpose of the firm, then the method of net present value should be used;

if used as a selection criterion the IRR method, then it leads to the maximization of the percentage of growth of the firm. When the goal of a firm is to increase its value, the most important characteristic of investment projects is the degree of return, the ability to earn cash for reinvestment.

Estimating cash flows of varying duration

In cases where there is doubt about the correctness of the comparison using the considered indicators of projects with different implementation periods, you can resort to one of the following methods.

Chain repeat method

When using this method, find the smallest common multiple of the terms of implementation of the estimated projects. Build new cash flows from multiple project implementations, assuming that costs and revenues will remain the same. The use of this method in practice can be associated with complex calculations if several projects are being considered and each will need to be repeated several times to match all the dates.

A number of simple ratios are used to estimate cash flows and specialized complex indicators, which include the following.

- 1. Moment and interval multipliers, reflecting the financial results of the enterprise and defined as the ratio of the enterprise share price to a number of final indicators of the results of activities at a particular point in time or for a period. Momentary indicators include, for example:

- price-to-gross income ratio;

- price-to-earnings ratio before tax;

- price / net profit ratio;

- the ratio of price and book value of equity capital.

As interval multipliers are used, for example:

- price-to-earnings ratio;

- price-to-earnings ratio;

- price-cash flow ratio;

- the ratio of price and dividend payments.

- 2. Indicators of profitability, for example:

- return on assets ( ROA) - is defined as the ratio of net profit to the amount of assets;

- return on investment ( ROI) - calculated as the return (the amount of income received, net profit) on the invested capital;

- return on equity ( ROE) - is calculated as the ratio of net profit to the company's share capital.

- 3. The capitalization method exists in two modifications:

- direct capitalization, according to which the value of an enterprise is determined as the ratio of the net annual income that the enterprise receives to the capitalization rate calculated by equity;

- mixed investments, when the value of the enterprise is determined as the ratio of the net annual income that the enterprise receives to the total capitalization rate, which is determined by the weighted average of the cost of equity and debt capital.

- 4. Models for evaluating the cost based on profit indicators, including

number using:

- the indicator of profit before interest, taxes and depreciation deductions - EBITDA, which allows you to determine the profit of an enterprise from its core activities and compare it with a similar indicator of other enterprises;

- operating profit before interest and taxes - EBIT (Earnings before interest and taxes), net operating income net of adjusted taxes - NOPLAT (Net operating profit (less adjusted tax) and net operating income before interest expense - NOPAT (Net operating profit after tax). The following scheme for calculating indicators is possible:

Revenue - Expenses from ordinary activities = EBIT - Tax(Adjusted Income Tax) = NOPLAT.

The income tax used in the calculation is called adjusted when there are differences between the financial and tax reporting of the enterprise. The current income tax in the income statement and the amount of income tax calculated to be paid to the budget according to the tax return, as a rule, have different meanings. Indicators NOPLAT and NOPAT associated with the calculation of the value of economic value added EVA(English - economic value added). If, when calculating the value NOPLAT data is taken from tax statements, then the value of income tax is taken from the financial statements.

For calculation NOPLAT the operating profit value is used EBIT from the main activity, adjusted by the amount of taxes that the company would have paid if it did not have non-operating income and expenses and borrowed sources of financing. Company McKinsey & Co suggested the following calculation method NOPLAT

EBIT- Income tax from the income statement - Tax shield on interest payments (Interest payments x Tax rate) - Tax on non-operating income +

Change in the amount of deferred tax payments = NOPLAT.

Index NOPAT in the case when tax reporting is taken as a basis, it can be calculated using the formula:

NOPAT = EBIT- Tax = EBIT ( 1 - CT),

where CT - operating profit tax rate EBIT.

5. Indicator of cash flows CF (cash flow) determines the financial result of the enterprise and is calculated as the difference between the total amount of receipts and expenditures of capital. When capital investment exceeds the amount of return, the value CF will be negative, otherwise it will be positive. Unlike profit-based valuation metrics, the metric CE takes into account investment investments immediately - in the year of their implementation, and not in parts - through depreciation, as is customary in accounting when calculating profit. The enterprise value is determined from the expression:

Enterprise value = Present value of cash flows of the forecast period + Present value of cash flows

streams of the extended period.

The method is used when there is confidence in the correct determination of the value of discounted cash flows for the years of the forecast and extended periods.

- 6. Techniques combined into the concept of cost management VBM (value-based management), according to which the target management function is cash flows and the value of the enterprise. At the end of the XX century. indicators have been developed, for example MVA, SVA, CVA, CFROI, EVA allowing you to calculate cash flows and value

McKinsey & Co, Copeland, Koller, Murrin. Valuation. 3rd edition, p. 163. Model of economic profit. See http://fmexp.com.ua/ru/models/eva, 2010.

enterprises when used as an information base

financial statements of the enterprise:

- using cash flow metrics such as FCF (free cash flow), ECF (equity cash flow - cash flows to shareholders). This group of indicators operates in terms of discounted cash flows. In this case, the discount rate is calculated for the indicator ECF by model SARM, and to calculate the indicator FCF is often accepted equal to weighted average capital price WACC. As a result of calculating the indicator FCF the cash flow available to shareholders and creditors of the company is recorded, and the indicator ECF- cash flow available to shareholders after debt repayment;

- using indicators NPV(eng, net present value) and AGC(eng, adjusted present value). This group of indicators is used, for example, in the case when an enterprise can be presented as a set of parts, each of which can be assessed as an independent investment project. If there are one-off or time-spaced investments, the company uses the indicator NPV. NPV is the net cash flow, defined as the difference between cash inflows and outflows, adjusted to the current point in time. It characterizes the amount of money that an investor can receive after the proceeds have recouped investments and payments. Difference in the calculation of the indicator AGC from the calculation of the indicator NPV consists in using the effect of "tax protection";

- on the basis of combining income and expenses - model EVO (Edwards - Bell - Ohlson valuation model). In this case, the advantages of cost and income approaches are used. The value of an enterprise is calculated using the present value of its net assets and a discounted flow, defined as the deviation of the amount of profit from its average value for the industry;

- based on the concept of residual income using indicators EUA(eng, economic value added - economic value added), AMU(eng, market value added - market value added) and SUA(eng, cash value added - added value of residual cash flow).

Let's consider some of the evaluation indicators.

- 1. Indicator of market value added MVA allows you to value an item based on market capitalization and the market value of the debt. It shows the present value of current and future cash flows. Index MVA is calculated as the difference between the market price of capital and the amount of capital attracted by the enterprise in the form of investments. The higher the value of this indicator, the higher the performance of the enterprise is assessed. The disadvantage of the indicator is that it does not take into account intermediate returns to shareholders and the opportunity cost of capital invested.

- 2. Indicator SVA(English - shareholder value added) is called a measure of calculating the value based on "shareholder" value added. It is calculated as the difference between the value of the share capital before and after the transaction. When calculating this indicator, it is assumed that added value for shareholders is created in the case when the value of the return on investment capital ROIC more than the weighted average cost of attracted capital WACC. This will only last during the period when the entity is actively using its competitive advantages... As soon as the competition in this area increases, ROIC narrowing, the gap between ROIC and WACC becomes insignificant and the creation of “shareholder” added value ceases.

There is another definition SVA is the increment between the estimated and book value of the share capital. The disadvantage of this method is the difficulty in predicting cash flows. The expression for calculating the cost is:

Enterprise value = Market value of invested capital at the beginning of the period + Amount SVA forecast period +

The market value of assets of non-conducting activities.

- 3. Indicator of total shareholder return TSR(English - total shareholders return) characterizes the overall effect of the investment income of shareholders in the form of dividends, an increase or decrease in the company's cash flows due to an increase or decrease in the share price for a certain period. It determines the income for the period of ownership of the company's shares and is calculated as the ratio of the difference in the company's share price at the end and the beginning of the analyzed period to the share price at the beginning of the period. The disadvantage of this indicator is that it does not allow taking into account the risk associated with investments, which is calculated in a relative form and determines the percentage of return on invested capital, and not the amount returned, etc.

- 4. The indicator of cash flow is determined by the return on invested capital CFROI(English - cash flow return on investment) as the ratio of the adjusted cash inflow at current prices to the adjusted cash outflow at current prices. The advantage of the indicator is that it is adjusted for inflation, since the calculation is based on indicators expressed in current prices. In the case when the value of the indicator is greater than the value set by the investors, the company generates cash flows, and if not, then the value of the company decreases. The disadvantage is that the result is presented as a relative measure and not as a sum of value.

- 5. Indicator CVA(English - cash value added), otherwise referred to as the PM / Tsangl indicator. - residual cash flow), created in accordance with the residual income concept and is defined as the difference between operating cash flow and the product of the weighted average cost of capital by the adjusted total assets. In contrast to the indicator CFROI, this indicator takes into account the value WACC, and the adjustments are similar to those used to calculate the indicator EVA.

- 6. Balanced scorecard Bsc(English - balanced

scorecard) was developed by D. Norton and R. Kaplan. The purpose of the system Bsc is the achievement of the goals set by the enterprise and taking into account financial and non-financial factors for this. The system is based on the desire to take into account the interests of shareholders, buyers, creditors and other business partners.

System Bsc arose as a result of the need to take into account non-financial indicators in business valuation and the desire to take into account indicators that are not included in the financial statements. The purpose of its application is to get answers to a number of questions, including: how do customers, partners and authorities evaluate the company? government controlled, what are its competitive advantages, what are the volume and efficiency of innovation activities, what is the return on staff training and the implementation of corporate policy in the social life of the team?

For effective business management in this case, it is necessary to define values, objectives and a strategy acceptable to shareholders, debtors and creditors, and develop methods for quantifying these interests. As these issues are resolved, the system Bsc will become an important tool for managing cash flows.

7. Indicator of economic value added EVA(English - economic value added) used when it is difficult to determine the company's cash flows for the future. It is based on

the residual income method developed by A. Marshall. Metric-based enterprise value EVA in general form can be calculated by the formula:

Enterprise Value = Invested Capital +

Present value EVA forecast period +

Present value EVA extended period.