The calculation of wages at any commercial or state enterprise occurs in accordance with the legislative acts in force at a given time. Its amount depends on official salary prescribed in the employment contract, worked during a certain period of hours and other details. The amount due for payment is calculated by the accountant on the basis of a number of documents.

What is included in the calculation?

To date, two types of payment are most often practiced:

- Time . The first provides for a salary determined by the contract for the hours worked - an hour, a day, a month. Often a monthly rate is practiced. In this case, the total amount depends on the time worked during a certain period of time. It is mainly used in the calculation of salaries for employees who do not depend on the amount of the created product - accountants, teachers, managers.

- piecework . Depends on the amount of product created for a certain period. Often used in factories. It has several subspecies, which we will consider a little later.

Thus, time wages provide that the head of the enterprise or other official is required to maintain and fill out a time sheet. It is issued in the form No. T-13 and is filled out daily.

It should note:

- the number of working hours worked during the day;

- exits "at night" - from 22:00 to 6:00;

- exit to the work time(weekends, holidays);

- omissions due to various circumstances.

Piecework payment provides for the presence of a route map or an order for a certain amount of work. In addition, the following are taken into account: sick leave, orders for bonuses, orders for the issuance of material assistance.

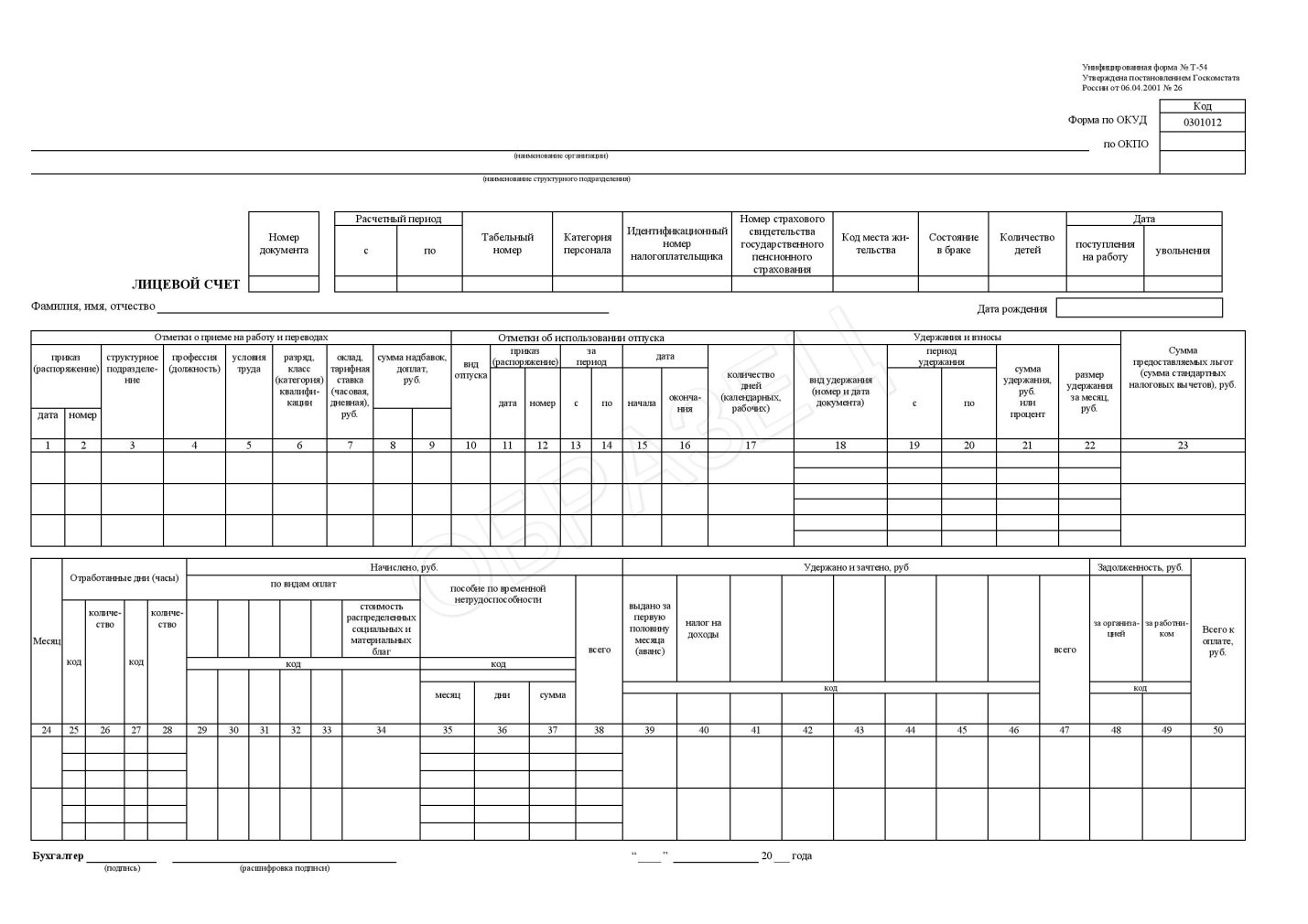

After hiring, each accountant must keep analytical records wages and fix it in the form No. T-54. This is the so-called personal account of the employee. The data specified in it will be taken into account when calculating hospital payments, vacation and other types of benefits.

You can find out how vacation pay is calculated.

Calculation formula and examples

Hourly pay provides for remuneration according to the time worked and the salary of the employee.

It is calculated as follows:

For monthly salary:

ZP \u003d O * CODE / KD, where

- O - fixed monthly salary;

- CODE - days worked;

- CD is the number of days in a month.

For hourly/daily fixed salary:

ZP \u003d KOV * O, where

- ZP - wages excluding taxes;

- KOV - the amount of hours worked;

- O - salary per unit of time.

Consider an example:

Tatyana Ivanovna has a monthly salary of 15,000 rubles. There were 21 working days in a month, but since she took a vacation at her own expense, she worked only 15 days. In this regard, she will be paid the following amount:

15,000*(15/21)=15,000*0.71= 10,714 rubles 30 kopecks.

Second example:

Oksana Viktorovna works with a daily salary of 670 rubles. This month she worked 19 days. Her salary will be:

670 * 19 \u003d 12,730 rubles.

As you can see, the formula for calculating wages for this type of payment is very simple.

Piecework payment - how to calculate?

With piecework wages, the amount of work performed is paid. At the same time, prices are taken into account in the ratio of the volume of work.

With piecework wages, wages are calculated according to the following formula:

ZP \u003d RI * CT, where

- RI - prices for the manufacture of one unit;

- CT - the number of products produced.

Consider the following example:

Ivan Ivanovich produced 100 engines in a month. The cost of one engine is 256 rubles. Thus, in a month he earned:

100 * 256 \u003d 25,600 rubles.

piece-progressive

It is worth considering separately such a type of payment as piecework-progressive, in which the price depends on the number of products produced for a certain period.

For example, if an employee produces 100 engines per month, then he receives 256 rubles for each. If it exceeds this norm, that is, it produces more than 100 engines per month, the cost of each engine produced in excess of the norm is already 300 rubles.

In this case, earnings for the first 100 engines and separately for subsequent ones are considered separately. The amounts received are cumulative.

For instance:

Ivan Ivanovich made 105 engines. His earnings were:

(100*256)+(5*300)=25,600+1,500= 28,100 rubles.

Other payment systems and their calculation

Depending on the specifics of the work, payment can be:

- chord . Often used when paying for the work of the brigade. In this case, the salary of the brigade as a whole is calculated and issued to the foreman. The workers divide the amount received among themselves according to the agreement existing in their brigade.

- Payment based on bonuses or interest . A bonus or commission system is applied to employees on whom the company's revenue depends (see also). Quite often it is applied to sales consultants, managers. There is a constant, fixed rate and a percentage of sales.

- shift work . The shift method of work provides for payment according to the employment contract - that is, by the time or for the amount of work performed. In this case, interest surcharges may be charged for difficult conditions labor. For going out of work, holidays payment is calculated in the amount of at least one daily or hourly rate on top of the salary. In addition, an allowance is paid for the shift method of work from 30% to 75% of the monthly salary. The interest rate depends on the region in which the work takes place. For example, Ivan Petrovich works on a rotational basis. His monthly rate is 12,000 rubles, the allowance for work in this region is 50% of the salary (O). Thus, his salary will be 12,000 + 50% O \u003d 12,000 + 6,000 \u003d 18,000 rubles per month of work.

Payment for holidays and night shifts

When working in shifts, each shift is paid depending on the tariff rate of each shift. It is either established by an employment contract or calculated by an accountant.

At the same time, it should be borne in mind that weekends and holidays are paid at a higher rate - an increase in the rate by 20%. In addition, exits at night from 22:00 to 06:00 are also subject to a rate increase of 20% of the cost of an hour of work.

payroll taxes

When calculating wages, do not forget about taxes. Thus, the employer is obliged to pay 30% of the amount of calculated wages to the insurance premium fund.

In addition, employees are charged 13% of their wages in personal income tax. Let's take a look at how taxes are calculated.

First of all, the tax is charged on the entire amount of wages, except for cases in which there is a tax deduction. So, a tax deduction is calculated from the total amount of wages, and only then the tax rate is calculated on the resulting value.

The right to a tax deduction has a number of socially unprotected categories, the list of which is prescribed in article 218 of the Tax Code of the Russian Federation. These include:

- Veterans of the Great Patriotic War, invalids, whose activities were connected with nuclear power plants. The tax deduction is 3000 rubles.

- Disabled people, participants of the Second World War, military personnel - 500 rubles.

- Parents who are dependent on one or two children - 1,400 rubles.

- Parents who are dependent on three or more children - 3,000 rubles.

The last two categories are restricted. So, after the amount of wages received from the beginning of the calendar year reaches 280,000 rubles, the tax deduction is not applied until the beginning of the next calendar year.

Example:

Ivan Ivanovich's monthly salary was 14,000 rubles, since he worked for a full month. He received a disability while working at a nuclear power plant. Thus, his tax deduction will be 3,000 rubles.

The personal income tax is calculated for him as follows:

(14,000 - 3,000) * 0.13 = 1430 rubles. This is the amount that must be withheld when receiving wages.

Thus, he will receive in his hands: 14,000 - 1430 \u003d 12,570 rubles.

Second example:

Alla Petrovna is the mother of two minor children. Her salary is 26,000 per month. By December, the total amount of wages paid to her will be 286,000 rubles, therefore, no tax deduction will be applied to her.

Payment procedure and calculation of delays

According to all the same legislation, wages must be paid at least 2 times a month. Allocate an advance, which is issued in the middle of the month and the actual salary.

The advance payment averages from 40 to 50% of the total amount of payments, at the end of the month the rest of the payments are issued. Usually this is the last day of the month, if it falls on a weekend - the last working day of the month. In case of untimely calculation of wages, the employer is obliged to pay a fine.

In addition, compensation is provided for the employee, which is issued at his request and amounts to 1/300 of the rate for each day of delay.

Video: Simple payroll

Familiarize yourself with the basic nuances of calculating and calculating wages. An experienced accountant will tell you how to correctly calculate wages, depending on the wage system you choose.

The calculation of wages is made by an accountant on the basis of a number of documents. There are two main systems of remuneration: piecework and time. The most popular is the time-based wage system - it is quite simple and is used in most industries.

The question of the procedure for calculating wages for employees never loses its relevance.

At the same time, accountants have to exercise increased vigilance, as the government periodically amends labor laws.

Therefore, it is necessary to understand in more detail what a payroll fund is and how to calculate it if a new tariff scale for calculating wages has been approved.

Basic information

Regardless of the form of ownership of the enterprise and the level of qualification of the employee, the employer is obliged to pay wages on a monthly basis.

This type of income is also paid when employees leave. The procedure for payment is determined by law.

As a result, wages are divided into two parts, the first of which is actually an advance ().

Advance payments are made every half a month, in the manner prescribed or.

There are two types of wages:

- Time wages.

- Piece wages.

Scheme: systems and forms of remuneration

Since time wages depend on the amount of time worked, the employer is required to keep a time sheet.

The document is to be completed daily. The table displays the following information:

- Number of hours worked per day.

- Number of night hours.

- Number of hours worked on holidays or weekends.

- Work breaks:

- because of illness;

- in connection with vacation;

- due to holidays.

The time sheet is the main document that is responsible for the correct calculation of wages for employees. Therefore, this document must comply with the unified.

The time sheet must contain all the necessary details and be correctly filled out. At the same time, an analytical accounting of wages is kept for each employee.

For this, the accounting department of the enterprise uses the personal accounts of employees (). This document is started for each employee from the moment of his official employment.

Filling in the personal account is carried out throughout the calendar year. After that, the accounting department closes the old one and opens a new one for the next year.

The retention period for these documents is 75 years. Information about the employee's income is taken from the following documents:

- time sheet;

- sick leave;

- performance list;

- other documents.

When calculating wages for persons who are on a salary, the enterprise must develop.

Salaries are displayed here depending on the category of employee. As for piecework earnings, it all depends on the amount of work performed.

As a consequence, the enterprise must use appropriate rates in relation to the work performed and its volumes. The company can develop the form of accounting documents independently.

The following primary documentation may be used:

- outfit;

A variation of piecework wages is piecework-bonus wages. The difference lies in the fact that the employer additionally pays the employee a fixed or percentage bonus.

If the enterprise has auxiliary production, then they can pay indirect piecework wages.

Such a system of remuneration implies the accrual of earnings to employees of auxiliary production in percentage from the amount of earnings of employees of the main unit.

However, regardless of the type of salary, the correct calculation of the wage fund depends on the following factors:

- accrued amount of earnings;

- payments made:

- For study leave.

- Due to business downtime.

- Per forced absenteeism.

- In connection with the improvement of the qualifications of the working staff.

- salary supplements;

- premium payments.

Scheme: surcharges and allowances

On the eve of the payment of wages, the employer must notify each employee:

- What does the monthly remuneration consist of?

- on the amount of all amounts accrued to the employee;

- on what and in what sizes deductions were made;

- about the total payment.

The employer can use a unified payroll form () or develop their own sample document.

Accrued income can be paid at the place of work or transferred to the employee's bank account. If the payment of wages falls on a weekend, then you need to shift it to the last working day of the week.

In accounting, the expenses of the enterprise for the remuneration of employees are related to the ordinary activities of the organization. To summarize information on settlements with employees, use account 70 "Settlements with personnel ...".

Table: basic wiring

As a result, payroll costs are displayed according to Dt 20, 26 "Production costs" and Kt 70 "Settlements with personnel ...".

Definitions

| Salary fund | This is the total amount of money in the enterprise, which is distributed among employees. This takes into account the results, quantity and quality of work performed. |

| Wage | This is the monthly remuneration for work that the employer pays to the employee. The amount of salary depends on the qualifications of the employee, the complexity and conditions of the work performed. The remuneration system may also include compensatory and incentive payments. |

| Time wage | This is a type of employee remuneration, in which the amount of earnings depends on the time actually worked. |

| piece wages | This is a type of employee remuneration, in which the amount of earnings depends on the amount of products produced or the amount of work performed. |

| Prepaid expense | A certain amount of money that is paid against future payments for work performed |

| District coefficient | An indicator used in relation to wages, aimed at compensating for additional costs and increased labor costs in the performance of work. Most often, the multiplying factor is used in regions with severe climatic conditions. The size of the coefficient depends on the zoning of the area. For example, in the Republic of Yakutia or Chukotka, the coefficient is 2%. Whereas for the cities of Tyumen, Yekaterinburg or Perm, regional indicators are set at the level of 1.15% |

| Northern surcharges | An indicator that is expressed as a percentage in relation to the employee's salary. The amount of allowances depends on the length of service of the employee in the regions of the Far North and the area where labor activity is carried out. Interest allowances apply to all types of employee income, including remuneration for long service. The minimum allowance is 30% and the maximum is 100%. |

| Shift work | A kind of work schedule in production, which involves a shift in working hours depending on the work shift. For example, an employee can work on Monday from 7 am to 7 pm, and on Wednesday from 7 pm to 7 am next day |

| Dismissal | Termination labor relations at the initiative of the employee or employer. Dismissal is usually accompanied by the termination of the employment contract, the payment of all amounts due to the employee and the issuance of a work book |

What does it consist of

An employee's salary may consist of the following payments:

- salary;

- income from piece work;

- remuneration from the amount of goods sold, paid as a percentage;

- non-monetary profit;

- wages when replacing public positions;

- overtime allowance;

- author's fee;

- salary supplement;

- monthly incentives.

However, when calculating the average earnings, the following is not taken into account:

- financial assistance;

- sick leave pay;

- food or travel expenses;

- costs associated with utilities;

- income received outside the billing period;

- bonuses that are not provided for by the wage system.

Normative base

The procedure for calculating and paying monthly remuneration is determined by the Labor Code. To calculate the average wage, you additionally need to take into account.

In this case, the payment of earnings to military personnel is carried out on the basis of.

State guarantees to citizens who work or live in difficult climatic conditions are provided within the framework of

When calculating allowances, you also need to take into account. Wage indexation for civil servants is based on.

While other employers are required to index the income of employees in the manner prescribed by the internal documents of the enterprise ().

The signal for indexation is usually a corresponding order of the government of the Russian Federation.

Moreover, if the internal documentation does not provide for the procedure for increasing the income of working personnel, then, according to officials, the employer is obliged to make the necessary changes to the local documents of the enterprise.

Unified forms of primary documents for accounting and remuneration have been approved.

The list of executive documents aimed at withholding amounts from the employee's salary is defined.

Taxation of income of individuals and legal entities carried out within the framework of the tax legislation. So, income tax is given.

Withholding insurance premiums is made on the basis of. Business transactions are accounted for in the established order.

Payroll procedure

The general procedure for calculating wages is determined by the Labor Code of the Russian Federation and other regulations adopted in accordance with the law.

However, the calculation of the monthly remuneration of employees includes a number of factors that affect not only the amount of salary, but also the procedure for its payment. Therefore, the components of this indicator will be discussed in more detail below.

Formula applied

You can calculate your payroll as follows:

Salary calculation formula:

Where, Zp - wages,

Or - the salary of the employee,

Dr - working days according to the calendar,

Od - days worked,

Pr - awards,

Pd - income tax,

Oud - hold.

The formula for calculating piecework wages:

Where, Zp - wages,

Wed - piece prices for products,

Kip - the number of units of manufactured products,

Pr - awards,

Dv - additional reward,

Pd - income tax,

Oud - hold.

Withholding includes the following payments:

- Amounts aimed at compensating for material losses.

- Repayment provided to the employee.

- Debt under executive documents.

- Withholding union dues.

- Voluntary contributions to the pension fund.

- Wrongly issued funds.

- Additional deductions at the request of the employee.

Also, regardless of the method of calculating wages, do not forget about withholding the amount of the previously paid advance.

How to calculate salary

In order to calculate payroll for an employee's salary, an accountant needs to adhere to the basic formula (see the subheading "Formula to Apply").

If the enterprise has approved a new tariff scale, then, starting from the next month, calculations are made in accordance with the changes made.

With northern and regional coefficient

When calculating earnings, it must be taken into account that the district coefficient is applied to actual earnings, that is, before income tax is deducted.

Therefore, when calculating wages, an accountant needs to sum up the official salary and other payments due to the employee and multiply the result by the value of the coefficient.

Let's say an employee is paid a salary of 35 thousand rubles. On the territory of Yekaterinburg, the regional coefficient is 1.15.

Payroll is calculated as follows:

However, now you need to withhold income tax, which was not taken into account in the initial calculation of earnings.

Therefore, the accountant needs to do the following:

As a result, the employee is entitled to a salary of 35017.5 rubles. With regard to the application of northern allowances, here it is necessary to take into account the percentage that is applied in a particular region (see the subheading “Definitions”).

Retirement (voluntarily)

Dismissal of an employee own will is a type of termination of the employment contract. However, must submit two weeks before the event.

If the employer agrees to dismissal without a two-week working off, then the calculation can be made in one day.

Therefore, the head of the enterprise needs to issue an appropriate order (). The unified form of the order is enshrined in a resolution of the State Statistics Committee.

The employee must read the order and put his signature. The last working day of the employee is the official date of termination of the employment contract.

Payment of the due amounts, including monthly remuneration, average earnings for business trip days or a bonus for unused vacation, is carried out directly on the day of dismissal ().

Based on the results of the final settlement, the employer must issue to the employee work book and . The calculation of the amount is based on the actual hours worked.

For example, an employee received his last salary on 01/01/2015. According to the order, the dismissal took place on 01/21/2015.

At the same time, the employee was on annual leave from 06/16/2014 to 07/17/2014. As a result, payroll will be calculated for the period from 01/01/2015 to 01/21/2015.

Whereas the calculation of the days unused vacation, which means that vacation payments must be made for the period from 07/18/2014 to 01/21/2015.

If after vacation

Each employee of the enterprise has the right to an annual paid dismissal (). During the vacation period, the employee retains workplace and average earnings.

At the same time, there are other types of vacations that can affect the way wages are calculated and their size. These include:

Pattern: Vacation

The variety of situations does not allow comparative analysis each of them. Therefore, we will consider a method for calculating salaries after the basic annual paid leave.

Suppose an employee took a vacation of 14 calendar days from 09/15/2015 to 09/28/2015. Whereas the rest of the month is worked out by him completely.

The salary of an employee is 25 thousand rubles. The calculation of wages for an incomplete month is as follows:

As a result, the employee is entitled to earnings in the amount of 13636.36 rubles.

Calculation example

To understand how to correctly calculate an advance or salary, you need to consider practical example. Suppose an employee S. N. Krevtsov has been working at the Rosselmash enterprise for one year.

The base salary of an employee is 30 thousand rubles. Wages are paid twice a month. The advance is paid on the 10th, and the second part of the salary is paid on the 3rd of the next month.

The settlement month will be April 2019, where 22 working days and 8 days off. The advance payment will be calculated from 1 to 10 April.

Therefore, the employee will have only 8 working days. The calculation is made as follows:

However, here it becomes necessary to withhold income tax, which was not taken into account when calculating the advance.

Therefore, the accountant needs to do the following operations:

Thus, the employee is entitled to a salary in the amount of 15,191 rubles. If the advance payment at the enterprise is 40%, then the calculations should be made as follows:

The second part of the salary is calculated as follows:

As a result, the employee is entitled to a salary of 14,100 rubles.

Emerging nuances

When calculating wages, the following questions arise in parallel:

- What is the procedure for withholding taxes.

- How is the 13th salary calculated.

- What to do if an employee has a shift work schedule.

- What is the procedure for calculating the salary of a teacher.

Withholding taxes

Paying an employee is the direct responsibility of the employer. In addition, as a tax agent, the company must withhold income tax from the employee's profits ().

The tax rate for Russian citizens is 13% of the amount of income received ().

Income tax is withheld once a month from the total amount of accrued wages. Therefore, no personal income tax is withheld separately from the advance.

The amount of withheld tax is transferred to the budget no later than the next day after the issuance of wages to the employee.

Amount 13 salary

The thirteenth salary is a kind of bonus that is paid at the end of the year. The decision on bonuses is made by the employer. The law does not provide for a mechanism for calculating such incentives.

Therefore, payments of this nature should be regulated by a collective agreement or a provision on bonuses.

Calculation and payment of the amount of encouragement can be made only after the end of the calendar year. Usually the size of 13 salaries is equal to the monthly salary of the employee.

How to deal with shift work

The staggered work schedule is usually used in those enterprises where the duration of the production process exceeds the statutory working hours.

Shift work is often accompanied by the introduction of a summarized accounting of working hours ().

Therefore, the administration of the enterprise must distribute the working hours of employees in such a way that the monthly indicator is not lower than the basic monthly norm of working hours (176 hours).

At such enterprises, a shift schedule is usually developed, according to which work is not allowed for two shifts in a row ().

The eight hour chart looks like this:

The twelve-hour shift schedule looks like this:

Payroll is based on actual hours worked. The hourly rate uses the following formula:

Where, Zp - wages,

Where, Zp - wages,

Koch - the number of hours worked,

PS - hourly rate.

The daily rate uses the following formula:

Where, Zp - wages,

Where, Zp - wages,

Koch - the number of days worked,

Ps - daily rate.

How to calculate teacher salary

In a budgetary institution, the amount of wages can be influenced by the seniority and skill level of the teacher.

The structure of labor compensation usually includes:

- official salary;

- school parameters regarding harmful conditions labor;

- availability of compensation payments;

- location of the region in relation to the Far North;

- increasing coefficients;

- other indicators.

Example of teacher salary calculation in Excel:

Concluding the review of labor legislation on the issue of payroll, it is necessary to recall a few key points. Salary is paid twice a month.

The main document responsible for the correct calculation of wages is the time sheet.

If earnings are calculated on the basis of the official salary, then the enterprise must have developed staffing.

Getting a job, any person, of course, plans to receive a salary. And rightly so, because every work must be paid. But in order to pay an employee his earnings, it is necessary to draw up a number of documents and calculate wages. How exactly to do it? We understand the issue.

Salary and rules for its payment

Everything important points regarding the payment of wages, the Labor Code regulates in our country, and the state acts as a guarantor of labor relations, which means supervision and control over the timely payment of labor and compliance by employers with the terms of payments. Article 136 Labor Code clearly defines the terms of payment of wages: twice a month.

This rule is not canceled by any provisions on remuneration of personnel adopted in specific institutions and organizations, since, according to the law, the internal documents of the organization cannot worsen the position of the employee in comparison with the conditions established by the Labor Code. This means that if an enterprise, by its internal regulation on remuneration, has established the payment of wages once a month, it violates the law, which may entail administrative liability. As for the clear deadlines (dates for payment of wages) in a month, they are established by the internal regulations of labor and collective agreements and cannot be violated.

As a rule, most organizations pay advance wages and wages to employees, although the Labor Code specifically refers to the payment of wages twice a month. If we are talking about an advance - a small amount on account of wages - it is necessary to clearly stipulate the terms and amount of the advance and fix this with a local act within the organization, informing the bank through which payments are made and the federal treasury. At the same time, it should be noted that the advance, unlike wages, does not depend on the volume of work performed or on the hours worked. Its size is determined by the organization, and the amount remains the same each time.

Documents for the calculation of wages, which are drawn up when applying for a job

The basis for the calculation of wages are documents that are drawn up when an employee is hired. These include an employment contract (contract) and an order for employment. One copy of the order (or an extract from the order) goes to the accounting department, where, on its basis, a personal account is opened for the employee and a personal card is created. The order indicates from what date the employee was hired, the amount of salary, allowances and additional payments, incentive payments that will be paid to him. If these documents are executed correctly and received by the accounting department on time, then the salary will be accrued and paid to the employee in a timely manner.

Other documents for payroll

Wages in any organization are calculated in accordance with established tariffs, rates, regulations on remuneration and according to information about the time worked by employees. Therefore, in order to answer the question of how to calculate a salary in a particular organization, it is necessary to study not only the provisions of the Labor Code, but also the internal documents of the enterprise. Indeed, in order to calculate wages, an accountant will need an order to hire an employee, a staffing table, an employment contract, a time sheet, and documents confirming the amount of work performed (for piecework wages). In addition, there are a number of documents that can change the amount of wages upward or downward. These include orders for bonuses to employees, memos, a collective agreement, and a regulation on remuneration.

Time and piecework pay

At state-owned enterprises, the system of remuneration of employees and the procedure for calculating wages is determined by the state, and at private enterprises - by the owner. At the same time, regardless of the type of organization, it is necessary to pay for the work of employees in full accordance with the Labor Code. Russian Federation. To date, there are time and piecework forms of remuneration.

- Time-based pay implies payment for the work of an employee, depending on the qualifications, the established salary and hours worked. The accounting of working time is maintained by an authorized employee in the time sheet, which indicates the number of hours worked for each working day, the number of night hours (if the position provides for work at night), the number of hours worked on holidays and weekends (if such work took place) etc. The report card also notes work absences due to temporary disability, vacations, absenteeism, weekends. The time sheet in this case is the main document for calculating wages, therefore it must comply with the T-13 form and the requirements of the law, have all the necessary details and be correctly filled out.

- A piecework wage depends on the work performed or the number of products produced. In this case, the prices that the company sets for products or work performed and the volume performed by the employee, which are taken into account in special documents (they are maintained by site foremen, shift supervisors, foremen or other employees who perform such functions), are taken as the basis. Forms of primary documents, in which records are kept of the products produced by each employee or work performed, the enterprise can develop independently. These can be both acts of work performed, as well as orders or route sheets (for transport companies). Usually at the enterprise, prices for specific works or products are constant. This means that to calculate the salary, you need to multiply the number of work performed or products produced by the piece rate. There is also a piece-bonus payment, when earnings are made up of payment for the work actually performed and a bonus, which can be set in a fixed or percentage amount. And for those organizations that have auxiliary and service production, which are necessary for the main production, an indirect piecework wage system is characteristic. Under such a system, employees of auxiliary production receive a salary based on a certain percentage of the total amount of earnings of employees of the main production. Organizations that primarily employ production teams often pay wages on a piece-rate basis. It is based on prices, and they, in turn, depend on the amount of production that was produced in a particular period. Brigades are paid according to the piece system, when the entire amount is divided among the members of the brigade, depending on the time worked by each employee.

payroll fund

In order to properly pay salaries to employees, it is necessary to calculate the payroll fund, which includes:

- accrued amounts of remuneration (in kind and in cash) and payments for unworked time (study leave, labor of minors, forced absenteeism, downtime that occurred through no fault of the employee, advanced training courses);

- allowances (if any), additional payments, remuneration, incentive and bonus payments (these include one-time bonuses, seniority bonuses, material aid, lump-sum remuneration based on performance, payment for parental leave, compensation for unused vacation);

- compensation, payments for housing, food, fuel (if provided).

Of course, payroll calculation in different organizations will be somewhat different, but everywhere this fund is calculated on the basis of planned working hours, production volume at tariff rates and piece rates. The most commonly used system is the planning of the wage fund for certain categories of workers, which differ in the system of payment. This means that you need to separately plan the payroll for managers, specialists, employees, pieceworkers and temporary workers (for this, the wages of employees of each group are calculated), and then calculate the total payroll.

Features of payroll

Let's take a closer look at the two payment options:

- Payment of salaries with the issuance of an advance. If the company pays advance payments and salaries to employees, then it is necessary to provide documents for accruals once a month. The advance payment is paid for the first half of the month and goes towards the future salary. Its size is agreed in advance and does not depend on the hours worked, therefore, the salary is not accrued (which means that there is no need additional documents: time sheets or closed orders), and is not reflected in the credit of account 70. This means that neither personal income tax nor social insurance contributions are accrued, since the advance is not an object of taxation (and wages that relate to remuneration for work performed are). Then, according to the results of the month, wages are calculated, which serves as the basis for taxes and fees to the pension fund and the social insurance fund.

- Payment of salaries for the first and second half of the month. If the internal documents of the organization establish the payment of wages twice a month, as required by the Labor Code, then all documents for the production of accruals must be submitted to the accounting department twice a month. When paying salaries twice a month, the question arises about paying personal income tax and fees: how to pay, once or twice a month? The answer to this question is quite clearly given by Article 226 of the Tax Code of the Russian Federation. It says that personal income tax and social tax must be paid once a month, but contributions to the pension fund should be paid twice a month.

Payroll Example

Let's try to make a simple calculation of the salary of an employee with time earnings. In the initial data: salary - 15,000 rubles and the right to a standard deduction, the amount of which, according to the law, is 400 rubles per month.

The calculation of personal income tax is made according to the formula: (salary - 400 rubles) x 13/100

In monetary terms, it will look like this: (15000 - 400) x 13/100 = 1898 rubles.

If the employee did not work all the working days in the month, then his salary, of course, will be less. In this case, you must first calculate the cost of the days worked based on the salary. Let's say that the employee was on sick leave, and out of 21 working days he worked only 15. Then we get: 15,000 / 21x15 = 10,714.29 rubles.

We calculate personal income tax: (10714.29 - 400) x 13/100 = 1341 rubles, and the amount due for handover: 10714.29 - 1341 = 9373.29 rubles. Of course, if the company provides for additional payments or the employee is entitled to other tax deductions, they are also taken into account when calculating wages, as well as possible deductions.

Taxes and withholding

I must say that there is some difference between the accrued wages and the amount that the employee receives in his hands. The real salary is the difference between the accrued salary and the amount withheld. What is a retained amount? Article 137 of the Labor Code of the Russian Federation clearly defines the types of possible deductions, which include:

Thus, the employee receives in his hands the amount of accrued wages, which has decreased by the size of all deductions. But here it is worth saying that the law stipulates the possible limit of deductions from each salary: it should not exceed 20%. For special cases, a threshold of 50% is provided, which cannot be exceeded even if deductions are required on several writ of execution.

For correct calculation wages on salary, it is necessary to separate these two concepts. Salary - the amount that is charged by the accounting department for transfer to the card.

It takes into account all bonuses, allowances, tax and other deductions for a certain, actually worked, period of time.

Salary - the amount of money to pay the employee, specified in the employment contract when hiring, that is, the zero rate for counting all subsequent payments.

Taking into account the data on the salary of the hired employee, all payroll actions are performed based on in due course calculation according to one of two systems of remuneration: time or piecework.

Complex various works, the results of which have no material embodiment, and production costs, which are determined only by the amount of time spent on these works, are calculated according to the time payment.

The use of this system is typical for settlements with personnel involved in creative, research or organizational areas of labor activity.

In the field of customer service or in the work of accounting, as well as in the conduct of scientific research, it is impossible to predict the quantity and quality of the results obtained in advance.

In such cases, only the value that determines the length of time spent on these actions is known. The value that makes up this value underlies the calculation of time wages.

Payment for the process of the employee's labor activity, at the end of which the employer must obtain quantitative and, in some cases, qualitative results, is calculated according to the piecework payment for labor costs.

The production of work based on a piece-rate contract is much more effective for increasing productivity in the fulfillment of labor obligations by the employee.

payroll fund

The totality of all expenses, including bonuses, allowances, compensation for the salary of personnel of any organizational structure, is the payroll fund.

The totality of all expenses, including bonuses, allowances, compensation for the salary of personnel of any organizational structure, is the payroll fund.

This indicator guides the analysis of spending on employee benefits.

With its help, costs are adjusted and optimized, salaries and rates are regulated.

All payments of pensions and insurance premiums provided for by legislative acts are accrued from the amount of the payroll fund, which is calculated based on the scheduled time for the performance of work, the volume of production, according to tariff and piece rates.

Features of payroll

- In the first case documents for accruals are submitted and processed twice a month, and with the mandatory payment of contributions to the pension fund. Payments under these documents are made twice a month;

- In the second- the salary is accrued once a month, but the payments are also two-time: a predetermined advance payment and a salary minus the received advance payment. The receipt of an advance is not subject to any tax deductions.

Indexing calculation

Compensation for monetary losses resulting from inflationary processes is intended to help the wage indexation mechanism.

Compensation for monetary losses resulting from inflationary processes is intended to help the wage indexation mechanism.

The procedure for calculating indexation is carried out in accordance with the legislative acts of the Russian Federation.

The frequency of application is set collective agreement and is made based on Rosstat data on the index of changes in consumer prices for goods and services, by multiplying the amount of payment by the index.

Payment delay calculation

On the day following the day determined for the payment of wages, in the absence of such, the period of delay begins.

On the day following the day determined for the payment of wages, in the absence of such, the period of delay begins.

According to its duration, the subsequent calculation of the compensation payments that are the responsibility of the employer is carried out, the amount of which directly depends on the duration of the delay.

It is equal to the amount obtained by multiplying the overdue payment by the number of days of delay and multiplied by the value of the adjusted refinancing rate.

Salary formula

To eliminate errors and simplify the process when calculating the amount due to the employee cash payments apply a verified formula according to which:

- In case of time payment- the salary is divided by the number of working calendar days and multiplied by the days actually worked, then all types of compensatory and incentive payments are added to this indicator. From the amount received as a result of these actions, income tax is deducted, as well as all deductions provided for by law in each specific case. The amount of deductions, according to the law, cannot be more than 20% of the total income;

- For piecework payment, the enterprise must maintain personalized statistics on the production of products. According to the orders drawn up on its basis, the amount of products or services produced by the employee is taken, multiplied by contract prices, added to compensation and incentive payments. To this value is added the remuneration for holidays and other non-working days. Income tax and all kinds of deductions are deducted from the amount received, the maximum amount of which is limited.

In addition to these basic calculation methods, there are additional systems wages, in which the formula used to calculate wages will differ slightly in terms of its constituent values:

- commission method - when using it, percentages of the volume of work performed are added to the amount of surcharges;

- lump-sum - the calculation of the earned amount before taxes and payments is made on the basis of the transfer of work performed, as well as regarding the contractual deadline for completion and the amount of payment;

- calculation based on variable salaries - accrual depends on the amount of revenue for a certain period.

Payroll example

For example, as a calculation of the wages of a particular employee, you should use the data of all due tax and social payments, as well as data on the labor costs incurred by him.

For example, as a calculation of the wages of a particular employee, you should use the data of all due tax and social payments, as well as data on the labor costs incurred by him.

If, for a month-long period of time established as a period for calculating wages, consisting of, say, 21 working days, the employee worked 20 days, and the salary specified in the employment contract is 10,000 rubles, then in this case, according to the formula for calculating salaries, 10,000 x 20/ 21 \u003d 9523r - we get a salary for the actual hours worked. Let's add bonuses in the amount of 10% of the salary: 9523 + 1000r = 10523r.

The next step is to determine the due deductions. It should be borne in mind that payments to these funds, wages are paid by the employer:

- pension;

- social insurance;

- compulsory health insurance.

An individual pays a mandatory tax of 13%: 10523 x 0.13 = 1368. If no other deductions are provided, the employee's salary will be: 10523 - 1368 = 9155 rubles.

Taxes and withholding

The economic meaning of the activity of any enterprise is to obtain the maximum possible profit through its commercial activities. carry out this activity employees of this structure. Obviously, accounting and wages are those accounting operations that no organization can do without, no matter what it does.

V last years legislators and regulatory authorities began to closely monitor the completeness and correctness of these payments and charges. Now it is especially important to do everything as competently and in a timely manner as possible. The responsibility that the legislation imposes on accounting staff in personnel accounting has increased significantly.

The procedure for counting and issuing funds

Salary accounting in the Russian Federation is carried out in accordance with the following standards:

- Labor Code of the Russian Federation in the latest edition.

- Tax Code of the Russian Federation in the latest edition.

- PBU 10/99 "Expenses of the organization".

- Federal Law of December 6, 2011 No. 402-FZ "On Accounting".

- Instructions for the application of the Chart of Accounts of Enterprises No. 94n 10/31/2000.

- Letters from Rostrud and the Ministry of Finance.

In accordance with the designated acts, accounting for wages is carried out once a month, but payments must be at least two.

The calculation of wages is carried out in strict adherence to the employment contract on a piece-work or time-based basis. The amount of time actually worked or the amount of work performed is taken into account.

These values are multiplied by the salary or rate due to the position, bonus payments are made, personal income tax is withheld. Set of quantities base salaries and bonuses in any enterprise is called the wage system. This system is reflected in the economic entity, labor contracts with employees and agreements to them.

These values are multiplied by the salary or rate due to the position, bonus payments are made, personal income tax is withheld. Set of quantities base salaries and bonuses in any enterprise is called the wage system. This system is reflected in the economic entity, labor contracts with employees and agreements to them.

It is allowed to pay salaries to the team in cash and. It is permissible, in agreement with employees, to pay for their work in kind, but not more than 20% of the total amount due.

Procedure and sample calculation

Suppose an employee of Astra LLC Medvedev Yu. V. got a job at the enterprise on a time basis. He was accepted into the organization as a merchandiser with a salary of 32,000 rubles. In November 2018, he worked a full 19 days. In the production calendar for 2018, there are 20 working days in November.

The salary corresponding to this position should be divided by the number of working days in a month and multiplied by the number of days actually worked:

- 32000/20*19=30400 rubles.

For the implementation of the sales plan at the enterprise, bonuses are set in accordance with the amount of 5% of the proceeds in excess of the plan for the entire team of employees (98 people). In November, the sales plan was exceeded by 3,450,000 rubles. Determine the amount of the premium:

- 3450000 * 5% / 98 = 1760 rubles.

This amount should be added to the salary calculated according to the salary:

- 30400+1760=32160 rubles.

In 2015, Yu. V. Medvedev wrote an application for granting him personal income tax on him (as a citizen dismissed from military service and performing international duty in the Republic of Afghanistan) and two children. Since January, his salary has exceeded 280,000, therefore, deductions for children in 2018 are no longer provided, and in order to find the base for personal income tax, only a deduction for the employee should be made:

- 32160-500=31660 rubles.

From the remaining amount, you should withhold and transfer to the personal income tax budget:

- 31660 * 13% \u003d 4115.80 rubles.

In the accounting department of the enterprise there is a writ of execution for deduction from Yu. V. Medvedev of alimony for the maintenance of his minor daughter in the amount of 25% of all earnings after tax. It is necessary to determine the amount of alimony, withhold them from the employee and transfer them to the current account indicated in the writ of execution:

- (32160-4115.80) * 25% = 7011.05 rubles.

In mid-November, an advance payment of 10,000 was transferred to Medvedev's card account. It should also be deducted from the funds due:

- 32160-4115.8-7011.05-10000=11033.15 rubles.

In total, for November 2018, Yu. V. Medvedev is supposed to pay 11,033.15 rubles.

You can learn all the complexities and nuances of this procedure from the following video:

Payroll calculation

Often, accountants and personnel officers of an enterprise need the amount of the payroll fund (FZP). This figure may be needed to fill out many forms of statistical, tax, accounting and management reporting.

Often, accountants and personnel officers of an enterprise need the amount of the payroll fund (FZP). This figure may be needed to fill out many forms of statistical, tax, accounting and management reporting.

The wage bill is the amount of all accruals made in the organization in favor of the team in cash and in kind. It includes the following items:

- Salary for salaries and tariffs for employees for.

- Salary accrued according to the norms of output on the piecework system.

- Salary in kind. Such payments are accounted for in ruble terms at average market prices.

- All types of incentive and incentive allowances and bonuses.

- Compensation for overtime or special conditions labour, as well as all other compensation accrued to the staff.

- Cash payments in the form of .

- Payments for fuel, food, housing, if they are systematic. The cost of gifts to employees and members of their families, promotions, vouchers. These payments are recorded at market prices.

Features of calculating piecework wages

It implies payments at rates for a separate unit of products (works, services) produced by an employee. That is, it is not the fact of being at the workplace for some time that is paid, but the result of labor activity.

There are the following types:

- Simple piecework the form implies accruals for each separately completed unit of production at the rates adopted at the enterprise. This system implies the existence of production standards and criteria for recognizing products as suitable. For marriage due to the fault of the employee, the payment is not charged.

- Piecework premium in addition to the above principles, it also implies the presence of bonus payments for the quality of the product, for the volume more accepted norms, for the cost of fewer materials.

- piece-progressive the system contains two different sets of prices: basic and increased. The latter are used in relation to products produced in excess of the planned values.

- Indirect piecework regulates not only the amount of goods produced by each individual worker, but also the percentage of his participation in the total mass. The so-called KTU (labor participation rate) is widespread here.

- chord similar in essence to a brigade contract. It forms a chord task and a wage fund for a specific task, which is subsequently divided among all employees in proportion to the contribution of each.

Documenting

Primary documents for accounting for wages are unified forms and developed by the organization itself. Such a norm is provided for in the new law on accounting. If the accountant independently develops the forms of documents, this must be reflected in the accounting policy of the enterprise. All required details must be present in such registers.

Primary documents for accounting for wages are unified forms and developed by the organization itself. Such a norm is provided for in the new law on accounting. If the accountant independently develops the forms of documents, this must be reflected in the accounting policy of the enterprise. All required details must be present in such registers.

Shelf life personnel documents the highest among all accounting documents. Registers containing information about the length of service, working conditions, wage payments, the enterprise is obliged store 75 years. Therefore, the requirements for the competent preparation and accounting of such papers are extremely high.